It’s quite surreal to be actually living through a point in time that you know will become a key moment in history.

Almost overnight we accepted unprecedented limitations on our personal freedoms to protect our health. There was nearly instant complete rejection of traditions that have been around for thousands of years, such as shaking hands or Faire la bise (a kiss on the cheek) with colleagues, and a heartbreaking stop to embracing our friends and family. Instead we stand two metres apart and grandchildren connect with grandparents online or through glass windows – some of which we’ll eventually overcome but other behaviours will no doubt become part of the new cultural norms even after the virus threat has gone.

The changes are not just physical. We’ve all mentally adjusted and this has spilled over into financial decisions and behaviour, including a rapid movement towards a contactless ‘cashless’ society.

At time of writing, there has been a £645 billion expansion of the central bank-issued fiat money supply (called “QE” for Quantitative Easing). Interest rates are already close to zero here in the UK (and already negative in countries such as Germany) so you can’t offset inflation with interest from a bank account. The coming inflationary consequences of the new money printing combined with the bleak looking economic outlook post-Lockdown, means it’s crucial to protect the value of your earnings. But how can we protect our family’s savings with a bank account using money that is losing value? Well, in short, we can’t. But there are new banking solutions emerging that change the status quo.

Where there’s a commercial need, the private sector steps up

Many interesting new business models have emerged in this period of pandemic, such as exclusive restaurants now delivering their gourmet products packaged to be prepared and consumed at home for a far fresher experience than takeaway or home delivery can provide – with added customer satisfaction of it being (at least partly) ‘homemade’. Meat and vegetable produce providers who previously supplied restaurants have pivoted to deliver boxes of produce directly to homes, and local pubs are turning into food stores with freshly baked bread and other goods and produce. And there’s an entire industry developing around supplying personal protective equipment (PPE) for shops, businesses and everyday people.

It’s only natural that banking should evolve as people are also looking for ways to protect the value of their money and their access to it during these times. You might have already read that gold is great at protecting value. Whilst the price of gold can fluctuate (up and down) against the local fiat currency (eg £), it is proven to hold its value over time. But gold can be costly to purchase, particularly in smaller quantities, and a pain to store and insure. It’s also inconvenient and costly to sell when you need some cash. Not to mention there’s the matter of what you actually own – is it physical gold or just a paper instrument like an ETF or futures contract? So whilst gold may be great in many ways, it’s not money.

Money that’s 100% gold

The good news is that there is a solution available (for UK residents at least) to protect your money and savings now. Tally is the world’s first banking app to offer an everyday banking account for a non-government issued money that delivers seamless, instant depositing, spending and transfers of money that’s 100% physical gold.

Importantly, Tally customers have their own individual banking account and IBAN (International Bank Account Number) with a debit card – not a pooled customer pre-paid top up card. Also important to note, Tally is not a cryptocurrency. It is the first iteration we’ve seen of a new category of money that is asset-based (i.e. tied to a tangible asset).

One Tally is one milligram of physical gold ethically sourced and held in a globally accredited high security vault in Switzerland. When a Tally customer makes a deposit from their traditional bank account, their GBP or Euros instantly convert into Tally at the global gold market price. Customers can transfer Tally from their individual banking account to their pounds or euro account, and spend via their contactless Tally debit Mastercard®. Tally is accepted anywhere in the world that accepts Mastercard, and there are no transaction costs and no FX mark-ups. And free ATM withdrawals – which is important for when we’re allowed to travel again.

There are none of the purchase, storage or insurance costs that you get with buying gold. Just a simple single monthly subscription fee of 0.1% of the average monthly holding (i.e. 1.2% per annum), which covers all the operational costs of managing the banking platform and the gold infrastructure. For note, the value of pounds sterling has decreased relative to gold at an average rate of 7.8% per year over the past 20 years. Compare that with inflation measured using the Consumer Price Index ranging between 0.5% to 4.5% over the same period (currently targeting 2% annually), and its easy to see that gold would be very useful if it could be used as money with the familiarity of a banking account and debit card. Perhaps it’s time to consider a money upgrade that protects our savings from inflation and the money printing machine.

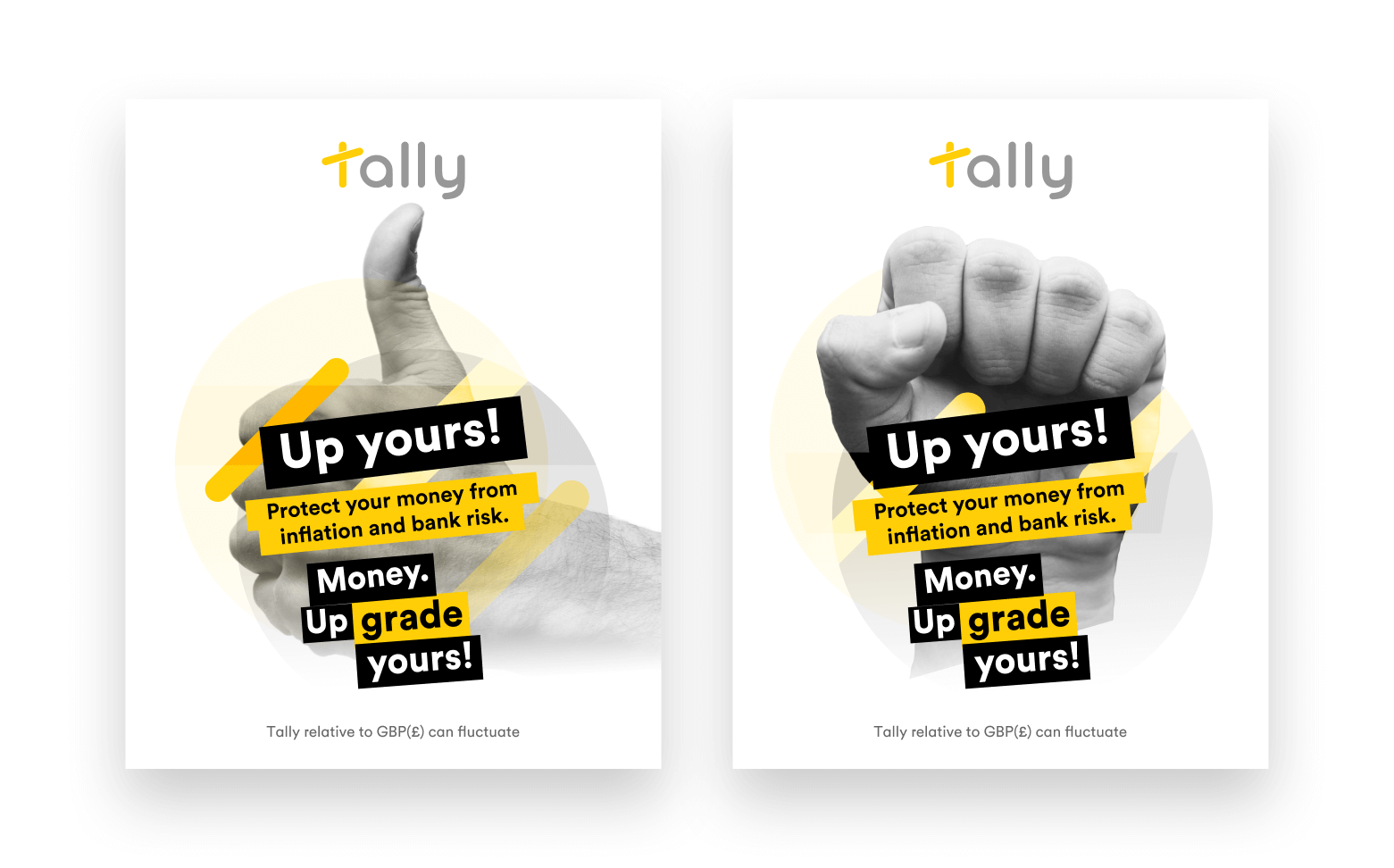

How Tally can help you ‘Up Yours’

Today Tally has launched a new ‘Up Yours’ campaign as a form of protest against the lack of incumbent banking choice, but with Tally’s optimism and cheeky humour. An evolution of our previous ‘Upgrade your money’ message, Tally is encouraging all customers (both existing and new) to Up(grade) the type of money and bank account they use. Tally will be targeting specific audience segments online to grow our customer base and encourage existing customers to use their Tally account more. And with the economic uncertainty around a post-lockdown world and the impending inflation, now that there’s upgraded money available, it’s time to “Up yours!”