Why asking “Where is my gold?” really matters

Gold is meant to be the safe haven. The thing you turn to when markets wobble, currencies lose purchasing power, or when you just want your hard-earned money to hold its value.

Here’s a question most digital gold owners never stop to ask: “Where is my gold, really?”

In a world filled with synthetic financial products and vague terms of service, having a direct line between your money and your asset is more important than ever.

TallyMoney was built to remove this ambiguity – to make ownership as clear and user-controlled as it should be.

With TallyMoney, you own physical gold

Every single tally in your TallyMoney account equals one milligram of real, physical gold – not a share in an ETF, not a digital token, and not a derivative or IOU.

- Bought through LBMA-accredited brokers

- It’s stored securely with Brinks® in Zurich, Switzerland

- It’s 100% insured against theft and damage

- And, crucially, you own it – not Tally, not a trust, not a pooled investment vehicle

Not just safe – independently verified

Unlike some platforms that rely on vague auditing promises or internal reporting, TallyMoney uses a robust process to ensure gold accountability.

We perform daily reconciliation operations to match the total weight of gold in the vault with the amount of tally in issue. This ensures every unit remains fully backed by physical gold.

Additionally, this reconciliation process is independently audited on a quarterly basis by PKF Littlejohn LLP, a leading UK audit firm, for further assurance.

When you check your TallyMoney balance, you’re not viewing a derivative or digital proxy. You’re seeing a precise measure of physical metal, personally allocated to you and verified through consistent checks and external audits.

Where exactly is your gold stored?

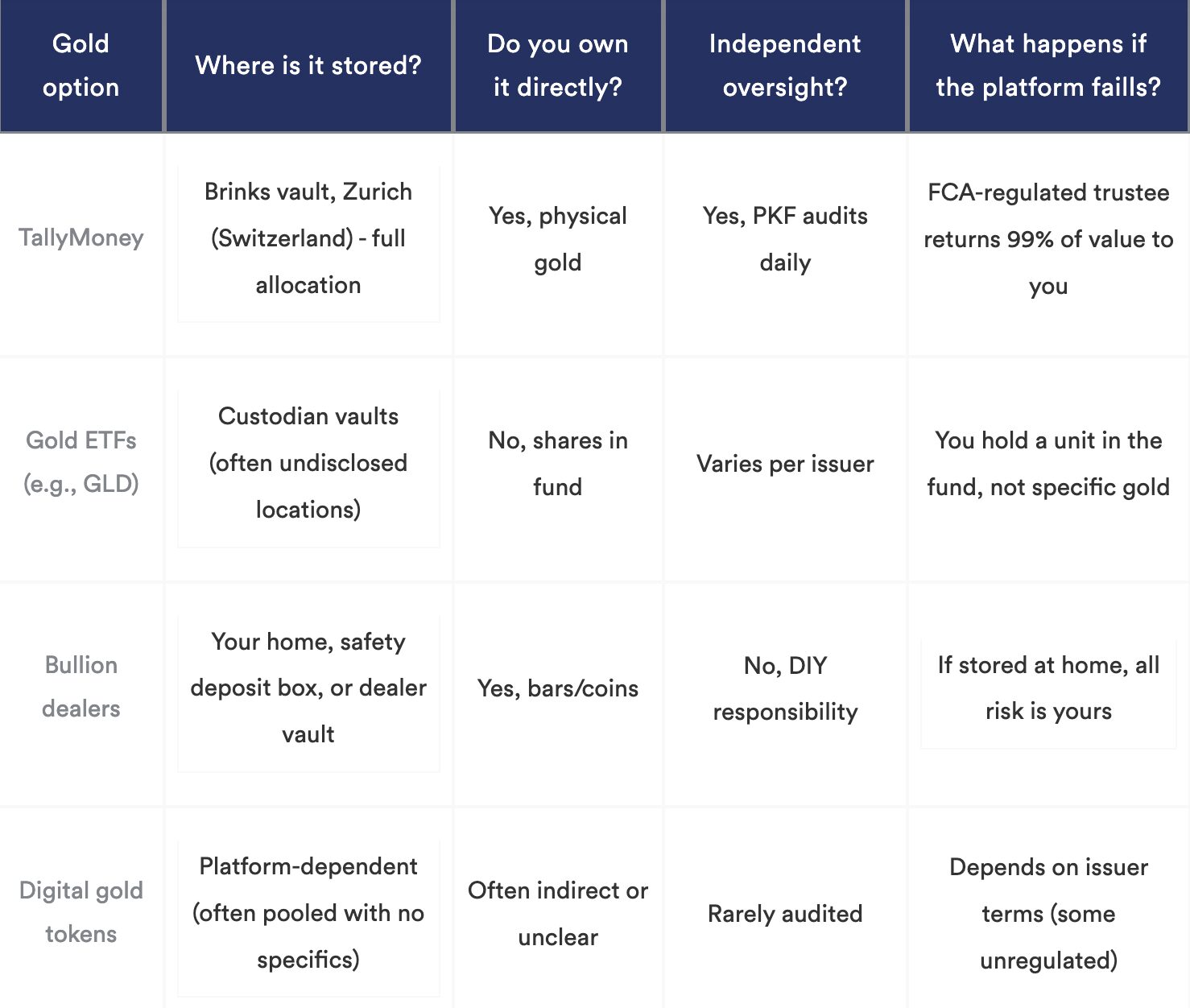

When people ask “Where is my gold?”, most platforms respond with something vague, like “held on behalf of the fund” or “stored by a third-party custodian.” But the real question is:

Can you see where it is, who owns it, and what happens to it if things go wrong?

Let’s compare how gold is stored (or not) across popular options:

TallyMoney wins on clarity, custody, and contingency:

- Your asset is held securely in Switzerland, outside the banking system.

- It’s 100% insured against theft or loss.

- Your holdings are reconciled daily, with quarterly independent audits confirming the accuracy of those records.

- And if anything happens? A UK-based, FCA-regulated trustee ensures your gold’s value is returned.

With TallyMoney, ownership is not an illusion – it’s a contract.

Final Thought: If You Don’t Know Where It Is, Do You Really Own It?

Gold is meant to offer certainty in uncertain times. But if your gold is tied to vague ETFs, unregulated tokens, or promises buried in terms and conditions, then it may not offer the peace of mind you’re hoping for.

TallyMoney delivers gold ownership you can understand, control, and trust. You can spend it, convert it, or hold it – knowing exactly where it is and who it belongs to.

Want to actually know where your asset is? Open your TallyMoney Account and protect your savings today.