Spoiler: Yes. But better, let’s break it down properly.

“Is Tally real gold?” is the most frequently searched question in our Help Centre. And we get why. In a world full of financial jargon, crypto confusion, paper-gold promises, and token-based promises, you want something solid.

So here’s the answer, plain and simple: Every tally® is 1 milligram of real, physical gold that you legally own. No smoke. No mirrors. Just real gold – digitised for spending and saving.

Let’s go through the facts.

What Is Tally, Exactly?

Tally® is a physical-asset currency. Instead of storing your money as fiat (like pounds), you hold it as gold. Your balance is measured in milligrams, and 1 tally = 1 milligram of gold, stored securely in Switzerland.

So when you deposit GBP into your TallyMoney account, we convert it into gold at the wholesale buy price. That gold is yours – insured, allocated, and stored in your name.

And unlike other systems, Tally doesn’t lend, reinvest or touch that gold. It’s ringfenced for you, and only you.

Where Is the Gold and Who Controls It?

Your gold is held in high-security vaults operated by Brink’s in Switzerland. These are not general storage units. They’re specialist vaults used by central banks and governments.

The gold is sourced from LBMA-accredited brokers, meaning it meets strict purity and ethical standards. TallyMoney partners with a trustee regulated by the UK’s Financial Conduct Authority (Woodside Corporate Services Ltd, FCA No. 467652) to make sure your ownership is legally protected.

Even in the unlikely event Tally ceases trading, the gold gets sold and the money returned to you. Promptly. Minus a 1% admin cost.

Can I Take Delivery of My Gold?

No. And here’s why.

Tally isn’t a precious metals dealer – we’re a monetary system. The point is to grow your wealth and sovereignty by being able to easily save and spend gold as best suits your needs.

However, if you wish to purchase physical bullion, you can use your TallyMoney Debit Mastercard to do so from a reputable dealer. That’s your choice.

How Does It Work in Everyday Life?

- Your gold is displayed as tally® in your account.

- You can send tally to UK bank accounts, make purchases with your Mastercard, or transfer it peer-to-peer. At the moment you do so, it converts from tally® to GBP (unless it’s tally-to-tally transfer).

- Your balance updates in real-time.

No lock-ins. No withdrawal penalties. No strange delays.

In short: Tally is gold ownership that fits into your daily life, as easy to use as a regular bank account, but without the hidden risks and fiat devaluation.

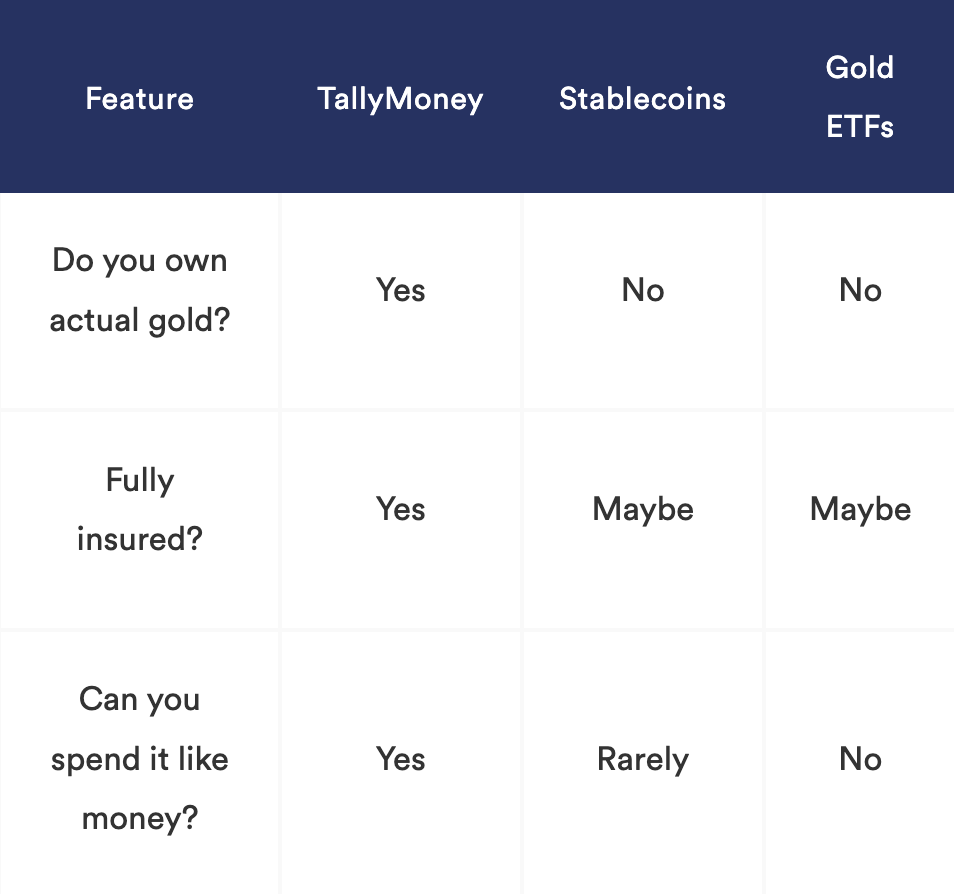

Tally vs. Stablecoins vs. ETFs

A lot of products claim to be “gold-backed,” but here’s the reality:

|

Feature

|

TallyMoney

|

Stablecoins

|

Gold ETFs

|

|---|---|---|---|

|

Do you own actual gold? |

Yes |

No |

No |

|

Fully insured? |

Yes |

Maybe |

Maybe |

|

Can you spend it like money? |

Yes |

Rarely |

No |

TallyMoney is not pegged to gold. It is gold. The unit of account is weight, not price.

And while stablecoins and ETFs may offer convenience, they rarely offer true ownership. With Tally, your gold isn’t just a number on a screen. It’s a tangible asset, held securely for you, and available instantly.

What If Something Goes Wrong?

It’s a fair question. Here’s the risk framework:

- You own the gold.

- It’s insured and stored by BRINKS in Switzerland

- There’s a security trustee agreement that activates if Tally ever goes under. In which case, proceeds from your gold are returned to you. No delays. No ambiguity.

We don’t gamble with your money. Period.

Compare that to traditional banks: your money is loaned out, leveraged, and often caught up in systemic risk. If a bank fails, your protection is capped. With Tally, your gold is safe, separated, and fully redeemable.

The Bigger Picture: What Makes Tally Different?

Tally isn’t trying to replicate existing systems. It’s here to challenge them. Our mission is to offer a currency that retains its value over time, free from inflation, speculation, and government interference.

We don’t charge percentage-based storage fees. We don’t offer credit or leverage your deposits. Instead, we offer:

- Pure gold ownership

- Gold you can spend

- Absolute transparency

And most importantly, we give you control. Your tally® balance is always 100% in gold, and that gold is never mixed, loaned, or leveraged.

How TallyMoney Fits Into a Financial Plan

TallyMoney isn’t about betting on the gold price. It’s about protecting your savings from long-term erosion. That makes it a powerful addition to a modern financial plan, particularly for those who:

- Want to hold a portion of savings outside the traditional banking system

- Are concerned about inflation or fiat currency depreciation

- Appreciate full transparency and asset ownership

If you’re building a diversified strategy, Tally can sit alongside ISAs, pensions, or savings accounts. But unlike those, it’s not tied to government policy or central banking moves. It’s based on a physical asset with intrinsic value.

And if you ever need to spend, your TallyMoney debit card is ready. No liquidations, no waiting periods. Just real-time, gold-based money.

Real Gold, Real Ownership, Real Confidence

Sceptical? That’s healthy. Many customers come to Tally after years of distrust in the financial system. What wins them over is transparency, legal ownership, and the ability to use their gold, not just look at it.

Since 2019, thousands of Brits have turned to Tally as a smarter way to hold their money. We issue regular reports, audit our reserves, and maintain a clean, regulation-compliant structure.

We encourage you to read our independent Gold Assurance Letter and FAQs. And if you’re still unsure, reach out to our support team. We’re here to help.

So yes, tally IS real gold, but it’s also so much more.

- 1 tally® = 1 milligram of physical, LBMA-certified gold.

- Stored in your name, in Brinks Switzerland.

- Fully insured and legally ringfenced.

- Spendable anytime with a debit Mastercard.

It’s a smarter, safer way to hold value, with none of the complexity of traditional gold ownership.

For full transparency, you can review our Gold Assurance documentation at: tallymoney.com/gold-assurance

Tally: it’s not just real gold. It’s real money.