FSCS Protection Is Going Up, Because The Pound is Going Down

From 1 December 2025, the UK’s deposit guarantee scheme will raise its protection limit from £85,000 to £120,000 per person, across each UK-authorised bank, building society, or credit union.

On first impressions, it might seem like the government is stepping up to protect the money in your bank. However, the reality is this increase is a reactive response to years of inflation and currency debasement that have systematically eroded the value of the pound sterling.

Why the Increase is Happening

One of the primary reasons regulators are increasing the deposit protection limit is quite simply because inflation has diminished the pound’s purchasing power.

The last time the deposit protection limit was updated was in 2017 at £85,000. Sadly, £85,000 today buys far less than it did eight years ago. Raising the deposit protection limit is a reactionary measure to limit the damage done by years of reckless spending.

Another reason is to try and keep the public trusting the financial system. According to Sam Woods, Deputy Governor for Prudential Regulation at the Bank of England: “This change will help maintain the public’s confidence in the safety of their money … Public confidence supports the strength of our financial system.”.

When you put two and two together, it becomes clear that the reason regulators have hiked the cap is because inflation has eroded the purchasing power of the pound so much that the public have lost confidence in the financial system.

If the Cap Had Kept Pace with Gold, What Would It Be?

While the FSCS deposit protection limit has been raised to £120,000, it’s worth asking how much that limit would need to be if it simply reflected the growth of gold. Let’s look at the data:

- The gold price in GBP has surged in recent years. For example, in the last 3 years alone, the price of gold increased by around 108%.

- If we apply a similar uplift to the £85,000 base from 2017, the deposit protection limit would be around £175,000

- This means the £120,000 limit actually falls well short of protecting savings in terms of real-value equivalence with gold.

- In other words: you’re “safer” in nominal terms, but not in real terms.

Where Does the Money Come From If Banks Fail?

Here’s the uncomfortable truth: if a large bank (or banks) goes under and the FSCS needs to pay out significant sums, that money doesn’t magically exist in a vault somewhere. Here’s what happens:

- The FSCS is funded by a levy on the financial services industry, but in a systemic event, the costs would be much larger than any one year’s levy.

- The government would need to print new money to cover liabilities.

- When new money is printed, the pound’s value weakens further

- So if banks were to go under, the compensation you would get would be significantly devalued by the time you get it.

Why TallyMoney Offers Better Protection

With TallyMoney, you’re not tied to a system of inflation and currency debasement. Gold can’t be created out of thin air, and with TallyMoney, you own real, LBMA-accredited gold, fully insured and 100% yours.

If your bank goes under, the compensation you receive is capped and debased. In the unlikely event that TallyMoney ever ceased trading, you would receive all of the proceeds of your gold minus a 1% administration fee – a significantly better outcome.

TallyMoney isn’t just an alternative to the banking system, it’s a fundamentally different way to protect and use your savings.

Real Protection Starts with Real Value

If you’ve worked hard to save and want more than a promise, it’s worth asking: are you safeguarding the value of your savings or simply the number in the account?

With TallyMoney, you hold gold, not just protection. It’s real value that can’t be eroded by inflation.

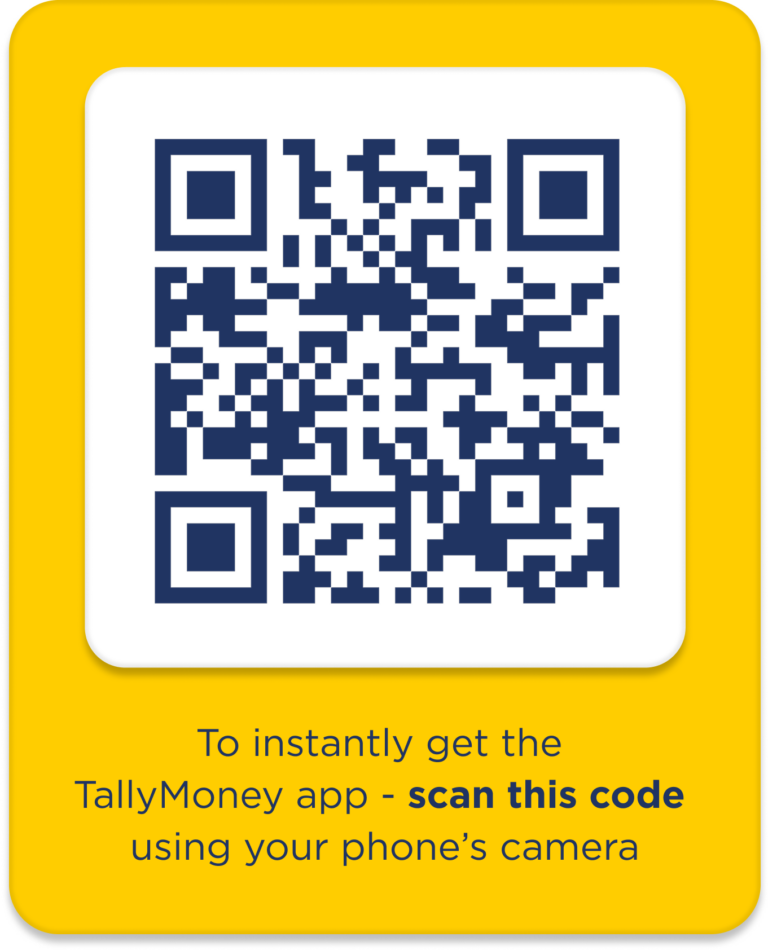

Open your TallyMoney account now and give your savings the asset-based protection they deserve.