Gold Over Gimmicks: The Real Path to Early Retirement Security

If you’ve built up savings but can’t trust them to hold their value, early retirement shouldn’t feel like a roll of the dice. You’ve worked hard, made the right moves, and now you’re looking for security, not speculation. But with inflation, shifting pension rules and the steady erosion of savings, the idea of a secure early retirement feels less certain than ever.

For many people planning their retirement in the UK, there’s an uneasy realisation setting in. Traditional savings aren’t holding their value. Pensions aren’t as protected as they once were. And the financial system? It’s starting to feel like a deck stacked against the very people who fund it.

Gold, however, has always played a different game. And now, thanks to platforms like TallyMoney, it’s finally practical too.

Why Early Retirement Is Getting Harder for the Wealthy

Let’s be clear: having wealth isn’t the same as protecting it.

The average UK pension pot for people aged 55 to 64 is between £107,000 and £145,000, according to the ONS Wealth and Assets Survey. This figure is often significantly higher for some households, especially when you add property equity or personal investments. But it’s not the total figure that matters – it’s what that figure can actually buy in the years to come.

Inflation in March 2025 reached 3.2%, with core inflation running even hotter at 4.1%. That’s not a blip, it’s the cost of living increasing year after year, eating into your future purchasing power. The Bank of England might talk about keeping inflation “on target,” but real life isn’t lived in forecasts.

Even so-called “high-interest” savings accounts – often marketed as safe havens – aren’t keeping up. The best rates, according to Moneyfacts, are around 4 to 5 percent, but many come with restrictions. Once you factor in tax (especially if you’re a higher-rate taxpayer), the returns are slim at best.

What this means is clear: retiring early doesn’t just require saving more. It demands a way to protect what you’ve already saved.

The Changing Face of UK Pensions

Pensions used to be the cornerstone of retirement planning. You contributed, the fund grew, and at 55 you accessed a tax-free lump sum. But those rules are changing, and quickly.

From 2028, the normal minimum pension age is increasing from 55 to 57. That might not sound dramatic, but if your plan was to tap into your pension early and make the most of your freedom, you now need to wait two extra years. Or, act before the door shuts.

In 2024, the government scrapped the lifetime allowance on pensions. Good news? Maybe. But there are already strong signals that a new cap will be introduced under the current political leadership. Financial advisors and industry experts are warning this could catch early retirees off guard, especially those hoping to withdraw more than the tax-free amount.

There’s growing alarm about what happens to your pension when you die, and with good reason. From 2027, pension pots will be counted as part of your estate and subject to inheritance tax. On top of that, if your beneficiaries withdraw the funds as income, they could also face income tax. In total, your family could lose over 80% of your pension to taxes.

The message is no longer a warning – it’s a fact: the rules have changed. And if you’re planning to retire early, relying on yesterday’s assumptions could leave your legacy exposed.

When ‘Safe’ Stops Being Safe

Let’s say you’re 58 and thinking of retiring at 60. You’ve got your pension lined up, some savings, maybe a property or two. On paper, you’re in a strong position. But how much of that wealth is protected from inflation, taxation or policy changes?

Cash in the bank? It’s losing value every month to inflation, and good luck getting it out when you need it. Banks now question your reason for withdrawals, deciding whether you deserve access to your own money. ISAs? They offer some tax benefits, but most can’t keep pace with inflation. Stocks and shares? Possible growth, sure—but also the gut-punch of watching 10–20% of your wealth disappear overnight.

The financial industry has no shortage of alternatives to sell you: investment bonds, property funds, crypto portfolios, but they often come wrapped in fine print, high fees, and stomach-churning volatility. When you’re aiming to escape the rat race, not stay trapped in it, that’s hardly a solution.

Pre-retirees in the £100k+ income bracket often have diversified holdings already. They don’t want more risk – they want a place to rest their wealth.

This is where gold quietly enters the picture.

Gold: Steady When Everything Else Shakes

Gold doesn’t pay interest or dividends. It doesn’t go viral. But it does something far more valuable: it holds its worth.

The Financial Times recently compared gold and government gilts for inflation protection. The result? Gold wins. Gilts rely on government stability and central bank signals. Gold needs neither.

Historically, gold has outperformed GBP significantly. Since 1971, the pound has lost more than 90% of its purchasing power. Gold, meanwhile, has not only preserved its value—it’s increased it. If you’d held £50,000 in gold since 2000, it would now be worth well over £650,000. That’s without needing to predict markets or chase returns.

It’s why generations of economists have recommended holding at least 10% of your wealth in gold—as a hedge, a safeguard, and a store of value when everything else gets shaky.

In an age where even your savings account feels uncertain, gold remains the benchmark for real, stable value.

And yet, until recently, gold had one major flaw: it was hard to use.

Bridging the Gap: Gold That Works Like Money

Owning physical gold used to mean storing bars or coins in a safe or vault, difficult to liquidate and impossible to spend directly. That’s fine for a long-term hedge, but what about people who want to use their money, not just store it?

TallyMoney answers that. It takes physical gold, stores it securely, and gives you digital access to spend it like everyday money.

Each tally is one milligram of physical gold, owned by you. You can pay for your weekly shop, send a transfer to family, or move money in and out, all without converting back into pounds or worrying about hidden fees.

With TallyMoney, you’ll always know exactly where you stand. Every fee is clear, simple, and shown upfront before you sign up, no complex maths, no squinting at the small print. What you see in your app is exactly what you get. There are no FX margins, no hidden charges, and no banks lending out your deposits to fund someone else’s mortgage. It’s your gold, stored securely on your terms, and usable worldwide.

For pre-retirees, this matters. You’re not just planning for the future – you’re living in it.

The Practical Reality of a Gold-Based Account

With TallyMoney, physical gold becomes usable gold. You’re not locking it away in a vault that requires notice to access or selling at a markup to get cash out. You’re spending directly from your gold savings.

This changes the conversation entirely. Early retirement no longer has to mean picking between volatility or low interest. You can live from your savings while those savings retain their underlying value.

Your weekly food shop, your bills, the coffee at your local cafe – all of it can be paid from your TallyMoney account, without converting your gold into pounds first. You avoid currency erosion simply by exiting the system that caused it.

You’re not just opting for gold. You’re choosing freedom from inflation, from surprise tax raids, and from the traditional banking model that profits off your deposits.

Who This Is For – And Why They’re Moving Now

TallyMoney is not just a solution for high-net-worth investors or gold enthusiasts. It’s increasingly popular with professionals in their 50s and 60s who are:

- Withdrawing lump sums from pensions to avoid future policy shifts

- Looking to reduce exposure to currency risk while still having flexibility

- Managing wealth transfer plans and aiming to protect intergenerational value

- Wanting to avoid the surveillance and control of traditional financial institutions

These are not radical moves. They are rational ones. People are waking up to the reality that doing everything “right” in the current system does not guarantee protection.

And if there’s one thing both pre-retirees and establishment sceptics agree on, it’s this: it’s better to move early than to be caught reacting too late.

Final Thought: Your Retirement, Your Rules

Early retirement should be a time of clarity and control, not confusion and compromise. If you’ve reached the point in life where you’ve built the wealth, now it’s time to protect it.

Gold isn’t exciting. That’s the point. It’s honest, resilient and proven. And with TallyMoney, it’s finally easy to use in everyday life.

It’s important to highlight that the value of gold does fluctuate (up and down) in the short term. In the past 20 years, gold has increased in value on average by over 10% p.a. year on year. So whilst past performance is not necessarily an indicator of future returns, gold has historically proven to hold its value over thousands of years.

So before the rules change again, before inflation takes a bigger bite, and before another layer of financial complexity is added to your planning, take a moment to consider a simpler path.

Not just retirement. Not just early retirement. But a retirement that actually holds its value.

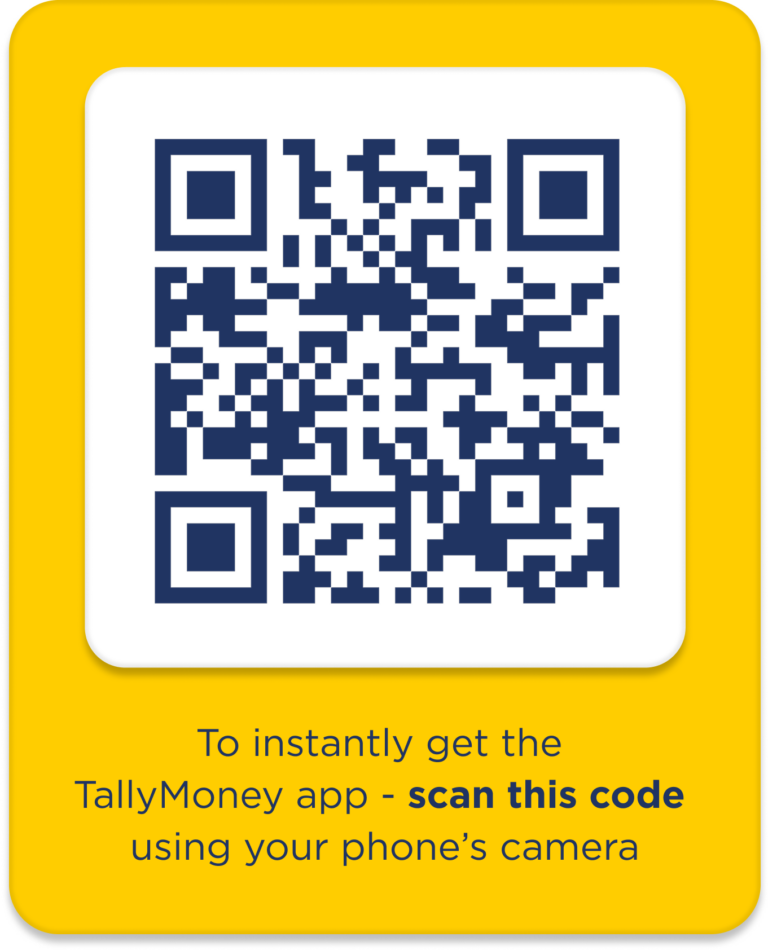

Protect your early retirement from inflation, market risk and government tinkering. Open a TallyMoney account today and hold your wealth in real, physical gold you can actually use.