There are changes ahead that could affect pensions, and if you’re 55 years of age or older, it’s important to stay abreast of what’s happening.

As the Autumn Budget approaches, many are expecting the Chancellor to reduce how much of your pension you can withdraw tax-free. At the moment, you can typically withdraw 25% of your pot (up to £268,265) tax free. However, that amount could soon be reduced to 20% or lower.

If you are nearing or already in retirement, you have a decision to make: should you withdraw your tax-free lump sum now, or sit tight and wait for the Autumn Budget announcements?

The Bigger Picture

The UK population is ageing, with approximately 11 million people aged 65 or over. And that figure is expected to rise to 22 million by 2072. This shift in demographics means pensions could very well be in the government’s crosshairs.

The State Pension age is also on the rise. Currently at 66, it is expected to be raised to 67 between 2026 and 2028, and then again to 68 by the mid-2040s. For many people, the State Pension alone will not be enough to live on and, for this reason, workplace and personal pensions have never been more important.

Why This Matters Now

Since April 2015, people aged 55 and over have, until now, had flexible access to their Defined Contribution pensions, including the ability to withdraw 25% tax-free. However, as the government increasingly looks for ways to target pensions, new complexity seems to be emerging. From April 2027, unused pension pots will be subject to inheritance tax. Combine that with the possibility of reducing the tax-free lump sum, and it’s understandable why more and more retirement age Brits are becoming nervous.

Recent figures show the number of people withdrawing their tax-free allowances rose 61% in August compared with last year. However, many financial advisers are urging caution. Once you’ve taken your lump sum out, you can’t put it back, and your money loses its ability to grow inside your pension. Not to mention, if you’re left holding cash, your purchasing power is eroded by inflation.

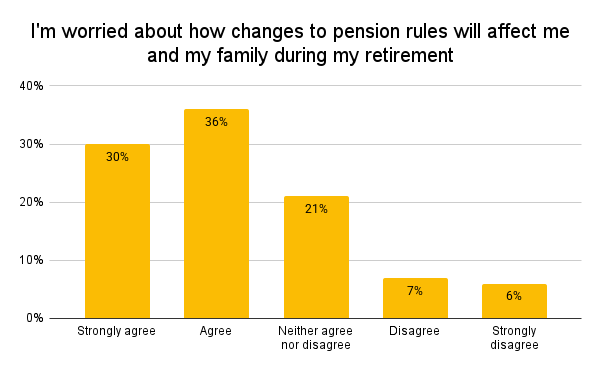

Our recent survey with over 2,000 UK adults, 55 years of age or older, shows that around two-thirds of Brits (66%) are worried about how changes to pension rules will affect them and their families during retirement, and 71% feel their overall financial security is under threat from the government’s policies.

The Opportunity and the Risk

If the tax-free allowance is cut in the Autumn Budget, people may end up with less tax-free cash than they had planned for. This is why many people are already withdrawing their lump sums ahead of the Autumn Budget in anticipation of the Chancellor announcing a new lower threshold.

But there’s a common pitfall. Taking money out of a pension early only really works if you know how to put it to use, otherwise you could end up holding your savings as cash in your bank account, where its value will be eroded by inflation over time.

How TallyMoney Fits In

TallyMoney empowers you to protect your wealth from the effects of inflation and ever-changing government policy. Here’s how:

- Your money is linked to physical gold, a proven store of value through decades of market and policy shifts.

- Your Tally account is tax efficient, with capital gains only triggered when you choose to sell, meaning you retain control.

- Unlike pensions, your money isn’t locked away until a certain age. You can access it whenever you need it.

If you’re concerned about the upcoming changes to your pension allowance, moving a portion of your tax-free withdrawal into TallyMoney can offer a way to avoid inflation, protect your retirement savings, and still stay flexible.

Final Thought

We can take it as a given that pension rules will change again. The real question is how you respond. Acting too hastily comes with downsides, whilst being complacent may leave you worse off if the 25% tax-free allowance is cut.

With TallyMoney, your retirement savings work for you, not against you. If you’re looking for a way to balance caution with opportunity, and keep your money working in a way you can see and control, TallyMoney could be a great solution for you.