We’ve made opening an account with TallyMoney easy. Really easy.

Just grab your mobile… follow the five steps below… and within minutes you could be saving and spending with actual, physical gold.

Complete control of your savings and inflation-busting returns in exchange for the time and effort it takes to make a cup of tea?

We’d say that’s a good deal.

So put the kettle on, and let’s take a look at what you need to do…

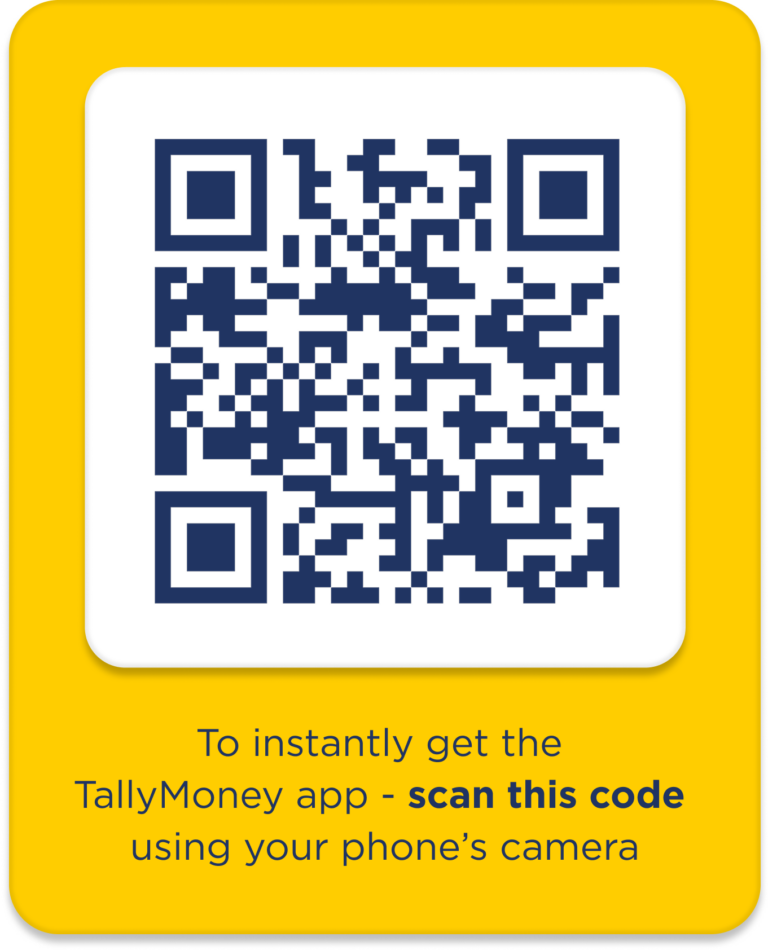

Step 1) Download TallyMoney App

First things first, you need to download our app—the new home for your savings.

Just visit our website here on your phone: www.tallymoney.com

Click “Get Tally.”

And you’ll be directed to the download page on your mobile device.

Alternatively, you can just search “TallyMoney” on your app store of choice. Whatever’s easiest.

Step 2) Tell us about yourself

Now you’ve installed the app, it’s time to set up your account.

Start by clicking “Open account” on the home screen.

Enter your mobile number and email, confirming both using the security codes we’ll send you.

Read our terms and conditions and click “agree” when you’re happy.

Then set your 4-digit passcode and enable facial recognition if you wish.

That’s the security stuff done. Now it’s time to tell us about you.

Enter your title, forename, surname, and date of birth before confirming your address.

Just like that, we’re halfway through.

Step 3) Verify your identity

As you’d expect, we need to make sure it’s actually you signing up for your account. So next, we’ll quickly verify your identity.

No need to meet in person—it’s 2024, after all. All you have to do is use your phone camera to provide evidence of a valid driver’s licence, passport, or EU national identity card.

The on-screen instructions will tell you what we need, whatever option you choose.

Next, we need a selfie so we can put a face to a name. But please don’t say cheese! We need the picture to match your ID.

After you’ve submitted your mugshot, take a look through our account fees and user agreement and click “agree” once you’re happy.

Now go and check on the brew while we quickly verify your identity—make sure you put the milk in before the water (controversial!).

Step 4) Activate your account

You’re nearly there.

Once we’ve given you the thumbs-up, click “activate my account” and create a secure password so only you can access your savings.

Next, when you’re ready, pop in your bank details of choice so you can pay your one-off £29 account activation fee…

Quickly tell us a bit about how you’re planning to use your account so we can optimise your experience…

And finally, follow the steps on screen to link a bank account so we can be sure where to send those tally to!

That’s it. You’re done!

Step 5) Start using Tally

Now it’s time to have a play with your brand-new TallyMoney account.

Looks nice, doesn’t it? We hope you like yellow.

From your home screen, you can transfer in money, set up a savings pot (we call them “safes”), add payees and view your balance.

Whatever you do, though, make sure you quickly order your new card by clicking the “card” tab at the bottom of the app.

You have two choices: A virtual card that exists in digital form on your phone and can only be used for online purchases. Or a physical card that works just like your normal bank card, requiring a PIN and activation prior to use.

Choose one of our award winning TallyMoney Debit Mastercards® and start saving and spending as you would normally… just way better.