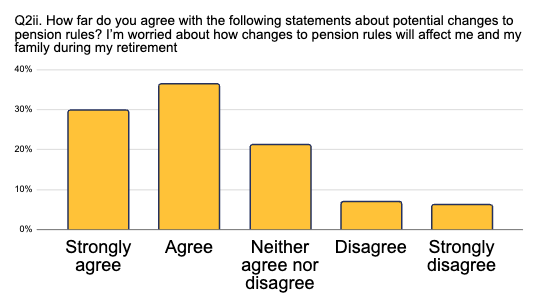

Many retirees have spent decades carefully saving for retirement, only to find that the rules keep changing—often in ways that make their financial future more uncertain. A recent survey revealed that 80% of UK adults aged 55+ agree or strongly agree that the government is punishing older generations with pension reforms.

This sentiment highlights the growing concern among retirees who have accumulated significant savings and now face unexpected tax changes. With shrinking tax-free allowances, new inheritance tax implications, and uncertainty around long-term value retention, those with substantial pension pots need a safe, stable alternative to protect their wealth.

Pension Reforms 2025: What’s Changing for Retirees?

The government insists pension reforms are about “fairness,” but for many retirees, it feels more like a stealth tax raid. However, the exact details of upcoming changes remain unclear, leaving those planning for retirement anxious about what might happen next. Here’s what is currently known:

1. Pension Reforms and the Shrinking Tax-Free Lump Sum

Starting in April 2025, the government will impose a £268,275 cap on tax-free pension withdrawals. This means that those with larger pension pots will see a portion of what was once tax-free money become taxable income. For those who have worked hard to build their savings, this could result in thousands in unexpected taxes. (MoneyHelper)

2. Inheritance Tax on Pensions: A Pension Reform Concern

- From April 2027, pensions will no longer be inheritance tax (IHT) exempt. If you pass away before drawing your pension, your heirs could face a significant tax bill, even if they were expecting to receive it tax-free. This change makes it more important than ever to consider alternative wealth preservation strategies. (This is Money)

- For pre-retirees who have spent years building up substantial pension funds, this could mean a significant portion of their savings is lost to tax instead of benefiting their loved ones. With IHT rates at 40% for estates above £325,000, the financial impact could be severe for families who were relying on this inheritance for their own financial security. (Gov.uk)

- Many retirees are now reassessing their estate planning options to ensure their savings aren’t subject to excessive taxation. Some are exploring tax-efficient wealth transfer strategies, including gifting funds before passing, transferring pensions into more flexible investment structures, or shifting assets into gold-based savings accounts like TallyMoney, which are not directly tied to government pension regulations.

- The uncertainty surrounding pension taxation has led many wealth-conscious pre-retirees to seek asset-based alternatives. Gold, as a globally recognized store of value, provides an option to preserve wealth in a way that is independent of government-imposed tax policies and inflation erosion. By holding savings in Tally, retirees can protect their purchasing power, avoid surprise tax liabilities, and ensure that their wealth remains intact for future generations.

These changes may seem small at first glance, but for those who have built substantial savings, it feels like a direct financial attack.

How Pension Reforms Are Forcing Retirees to Protect Their Wealth

Faced with unpredictable pension reforms, many retirees are reassessing their financial plans and seeking alternative ways to preserve and grow their wealth. Here’s how they are taking control:

- Reducing reliance on traditional pensions. With increasing government intervention in pension policies, retirees are exploring alternative savings vehicles that give them greater control over their money.

- Looking for inflation-proof assets. As pension values erode due to inflation and changing tax laws, many are shifting part of their wealth into gold-based assets like TallyMoney to ensure long-term value retention.

- Prioritizing tax-efficient wealth transfers. With inheritance tax now applying to pensions, retirees are restructuring their estate plans by moving funds into gold-based savings, which offer flexibility and security for future generations.

- Diversifying financial portfolios. Instead of relying solely on a pension pot, many are incorporating gold savings alongside ISAs and other investment accounts to protect against government policy shifts and economic instability.

Why Gold-Based Savings Like TallyMoney Offer a Pension Reform Alternative

1. Escape Government Control Over Your Savings

– With traditional pensions increasingly subject to higher taxation and reduced benefits, many retirees are seeking a system that offers true financial sovereignty. Unlike pensions, which are at the mercy of government policies, gold retains its value over time and isn’t subject to sudden regulatory changes.

2. Hedge Against Inflation and Market Volatility

– Traditional pensions and ISAs are tied to fiat currency, which loses value over time due to inflation. Gold, however, has maintained purchasing power for thousands of years. By holding savings in Tally, retirees can ensure their wealth is backed by real, physical gold rather than relying on depreciating fiat money. (Gold.org)

3. A Smarter Way to Pass Down Wealth

– With inheritance tax now applying to pensions, passing wealth down to loved ones is becoming increasingly expensive. TallyMoney provides a flexible way to preserve and transfer assets, ensuring that savings maintain their full value without being subject to surprise tax deductions.

Why You Can’t Afford to Wait: Act Before Pension Reforms Hit

1. Reevaluate Your Pension Strategy

– If you have a substantial pension pot, now is the time to rethink how you structure your savings. Consider moving some of your wealth into gold-based assets like TallyMoney before tax rules tighten further.

2. Diversify Beyond Traditional Pensions

– The days of relying solely on a pension pot are over. Gold-based savings accounts like Tally offer an inflation-resistant, government-proof, and tax-efficient way to protect your retirement funds.

3. Stay Ahead of Further Pension Reform Changes

– If these changes are happening now, what’s next? Watch for new Budget announcements that could further impact retirement savings. (Gov.uk)

Final Thoughts: Protect Your Wealth with Gold

The reality is pension reforms are changing retirement forever. The government can adjust the rules at any time, leaving pre-retirees vulnerable to higher taxes, reduced access, and lower payouts.

But you don’t have to be a passive victim.

Move your savings into physical assets like TallyMoney before tax hikes take effect.

Ensure your wealth retains value over time without being at the mercy of government policy.

Stay proactive and take control of your financial future today.

If 80% of retirees already feel betrayed, the question is: what will you do to protect your future?

The research presented in this blog was conducted online between 28th February 2025 and 3rd March 2025. The study was carried out with a sample size of 2,012 UK adults aged 55+. All research methodologies adhere strictly to the UK Market Research Society (MRS) Code of Conduct (2023) and comply with the Data Protection Act (2018) to ensure ethical and responsible data collection and processing.