Introduction

The pension tax raid is not a hypothetical concern—it’s already happening. Upcoming changes to pension taxation mean retirees may end up handing over a more significant chunk of their wealth to the government without even realising it.

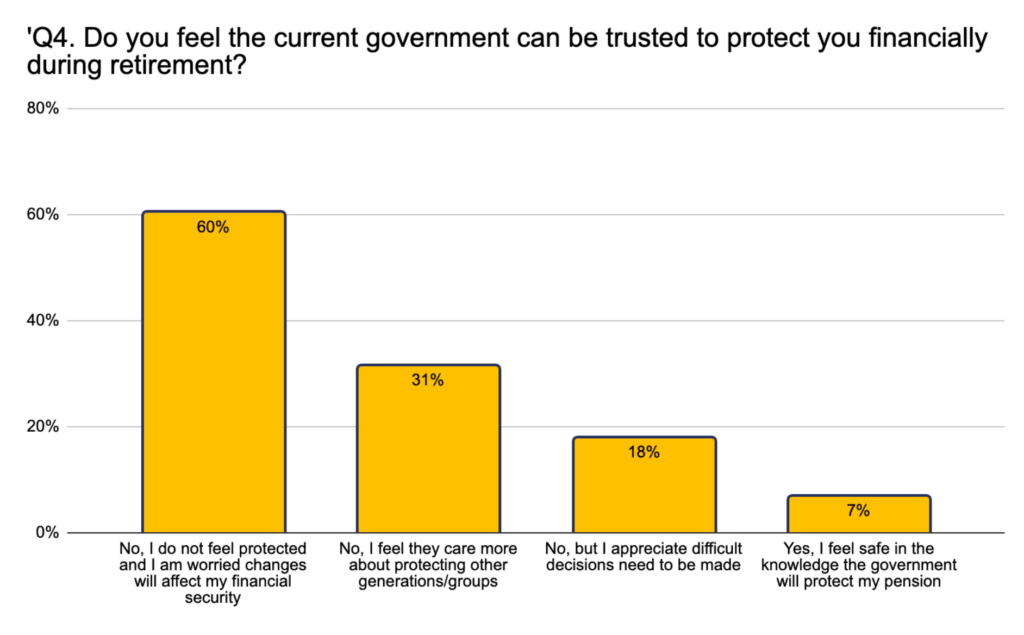

Our latest survey found that 60% of people don’t trust the government to protect their pensions, and with good reason:

- From April 2027, inheritance tax (IHT) will apply to pensions, meaning families could lose up to 40% of what’s left in a pension pot.

- The government’s decision to freeze tax thresholds has quietly increased the tax burden on pension withdrawals, even though tax rates haven’t officially risen.

- Concerns are growing that the 25% tax-free pension lump sum could be reduced, meaning pensioners would pay tax on a more significant portion of their savings.

With 31% of respondents believing the government prioritises other generations over retirees and 18% acknowledging difficult financial decisions must be made but questioning why pensioners should bear the cost, the question isn’t if another tax change is coming—it’s when.

Here’s how these changes may impact your retirement and what you can do to navigate them.

More of Your Pension Withdrawals Will Be Taxed

Many pre-retirees assume their tax burden will remain stable in retirement. However, frozen tax bands until 2028 mean that as pension incomes rise—either due to inflation or higher withdrawals—rising withdrawals push more retirees into higher tax brackets.

- The Personal Allowance (£12,570) and higher-rate tax band (£50,270) remain frozen until 2028.

- As pensioners increase withdrawals to cover rising living costs, more of their income becomes taxable.

Example: How Frozen Tax Bands Increase Your Tax Bill

- In 2024, a retiree withdrawing £50,000 per year from a private pension pays £7,486 in tax.

- By 2027, if their withdrawals rise to £55,000 due to inflation, they’ll pay £9,086 in tax —even though tax bands haven’t changed.

Outcome: more pensioners are unknowingly paying thousands more in tax, even without an official tax increase.

The 2027 Inheritance Tax Trap: Losing 40% of Your Pension

Pensions have been a tax-efficient way to pass wealth to loved ones for years. But from April 6, 2027, pensions will no longer be exempt from inheritance tax (IHT).

- Currently, if you die before age 75, your pension passes to beneficiaries tax-free.

- After 2027, HMRC will apply a 40% tax to pension pots… on amounts above the £325,000 IHT threshold.

Example: How Much Could You Lose?

You have a £500,000 pension pot at the time of your passing.

The first £325,000 is tax-free, but the remaining £175,000 is taxed at 40%.

HMRC takes £70,000 in tax, leaving your family with £430,000.

Outcome: beneficiaries may receive significantly less than expected due to the upcoming IHT rule changes.

Will Your 25% Tax-Free Pension Lump Sum Be Cut?

One of the few remaining pension benefits allows retirees to withdraw 25% of their pension tax-free, up to £268,275. However, some financial experts warn that this benefit could be reduced.

- By freezing the tax-free lump sum cap, the government is reducing its real value over time.

- If reduced to 20% or lower, more pensioners will face tax on withdrawals expected to be exempt.

What This Means for You

If the tax-free pension lump sum is cut, retirees may have less flexibility in structuring withdrawals and face unexpected tax bills.

How to Navigate These Pension Changes

With tax rule changes set to impact pension savings, now is the time to assess how these policies may affect your retirement plans.

Reassess Your Withdrawal Strategy

- Check if frozen tax bands impact your pension withdrawals and adjust your withdrawal rates accordingly.

Plan for Inheritance Tax Before It’s Too Late

- Understand how IHT will apply to pensions from 2027 and consider strategies that align with your financial goals.

Explore Asset-Based Savings Beyond Traditional Pensions

- With pensions facing new taxation risks, some retirees are looking into asset-based savings solutions that operate outside government-controlled pension schemes.

Final Thoughts: Protecting Your Retirement from Uncertainty

With pension tax changes already underway, retirees and pre-retirees must stay informed and assess how these policies may impact their long-term financial security.

Unlike pensions that face taxation shifts and inheritance tax liabilities, tally® offers a savings solution that operates outside government-controlled pension systems.

- TallyMoney lets you store your money in real, physical gold.

- Unlike pensions subject to changing tax rules, tally® remains independent from government policy adjustments.

If you’re concerned about how upcoming tax changes may impact your pension wealth, now is the time to explore a financial system that preserves value outside traditional pensions.

The research presented in this blog was conducted online between 28th February 2025 and 3rd March 2025. The study was carried out with a sample size of 2,012 UK adults aged 55+. All research methodologies adhere strictly to the UK Market Research Society (MRS) Code of Conduct (2023) and comply with the Data Protection Act (2018) to ensure ethical and responsible data collection and processing.