Why the UK State Pension Age Keeps Rising

The State Pension Age (SPA) in the UK is not fixed, and it hasn’t been for a long time. Currently set at 66 for men and women, it’s due to rise to 67 by 2028. That’s already locked in. However, further changes are not just possible – they’re likely.

In July 2025, the government revived the Pensions Commission, a policy body first introduced under Tony Blair, to confront what it’s calling a “retirement crisis” that risks leaving tomorrow’s pensioners poorer than today’s.

According to the official announcement, the review will focus on:

- The rising cost of the state pension

- Increased life expectancy

- Intergenerational fairness

- Whether SPA should rise again

It’s important to recognise what this signals: pension policy is not done shifting – and those within a decade of retirement will not necessarily be spared.

Could the State Pension Age Rise to 69, or 74?

Most people aged 55+ are aware of the planned increase to 67. Fewer know that respected think tanks are warning of more aggressive rises.

The Institute for Fiscal Studies (IFS) says the UK might be forced to push SPA to:

- 69 by 2049, and

- 74 by 2069

These aren’t arbitrary numbers. The IFS used economic models based on maintaining the triple lock system, a guarantee that pensions rise each year by inflation, earnings, or 2.5%, whichever is higher.

Without raising the pension age, says the IFS, the cost of funding retirement could become unsustainable.

These projections may seem far off, but policy changes don’t just affect young people. History shows governments accelerate timelines when economic conditions demand it.

The Bigger Picture – Why This Is Happening Now

The pressure to reform pensions comes from multiple directions:

1. Demographic pressure

By 2042, more than 24% of the UK population will be aged 65 or older. That means fewer people working, and more drawing benefits.

2. Longer life expectancy

When the state pension was introduced in 1948, life expectancy was approximately 68 years. Now it’s 81. People are drawing a pension for far longer than the system was designed to support.

3. Fiscal reality

The UK is running a persistent deficit. In an ageing society, cutting pension benefits or delaying retirement are among the few politically survivable levers governments have.

Combined, this creates an uncomfortable truth: delayed retirement is becoming a financial necessity for the state, but not necessarily for individuals.

How Pre-Retirees Feel About All This (Spoiler: Not Good)

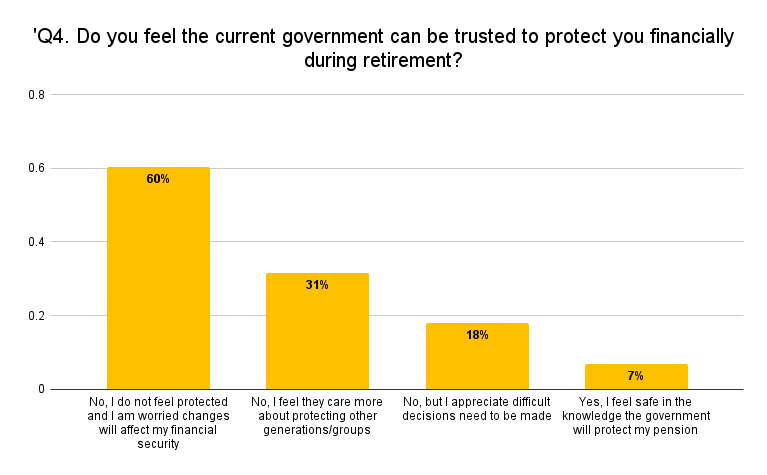

In March 2025, a nationally representative survey commissioned by TallyMoney asked people aged 55 and above how they felt about recent and expected changes to the UK pension system. The results show a deep crisis in trust:

- 60% said they do not feel protected and worry about how state changes will impact them

- 31% felt that other generations, or groups were being prioritised

Only 7% said they felt safe that their retirement was being safeguarded by the government

This paints a stark picture. Even people who followed the rules, contributed for decades, and made careful plans now feel like the ground is shifting under their feet.

For many, the issue isn’t just policy – it’s predictability. If the SPA can move, what else can change?

What Happens If the Pension Age Rises Again?

Let’s break down what a further SPA increase means for someone currently aged 55–60:

You may have to wait longer for your state pension

Even a one-year rise can cost you thousands in lost benefits.

You may need to work longer than planned

Especially if you were hoping to use state pension income to fund a semi-retirement lifestyle.

You may need to fund the gap yourself

If you retire at 66 but the new State Pension Age (SPA) becomes 68 or 69, that could mean two to three years of covering your living costs without the state’s support.

Your tax planning window is already narrowing

The longer you keep money inside a pension, the more vulnerable it becomes to new caps, rule changes, and tax grabs. For example, pension pots are now being considered part of your estate for inheritance tax purposes, a significant shift that’s already happening.

Can You Still Take Money Out of a Private Pension at 55?

Yes, and that’s a key distinction.

Private pension access remains at 55 (rising to 57 in 2028), unless further reforms are introduced. That means you may still be able to withdraw part or all of your defined contribution pension years before you qualify for the state pension.

What many pre-retirees are doing now is:

- Withdrawing the 25% tax-free lump sum while it’s still available

- Using that money to create a flexible buffer in case SPA rises

- Moving part of it into inflation-resistant savings, outside of pensions

But this strategy only works if you act before further changes are implemented. Once new caps or rules are introduced, they likely won’t be backdated in your favour.

Why Waiting Could Cost More Than You Think

Let’s be realistic: state pension income isn’t enough to live comfortably on anyway.

As of July 2025, the full new State Pension pays £230.25 per week, approximately £12,000 per year.

If you’re depending on this to replace a working income or support retirement lifestyle plans, you’ll likely fall short.

Meanwhile, cash savings accounts are being eroded by inflation. That means the longer you wait to act – whether by withdrawing, diversifying or reallocating – the less purchasing power your money holds.

That’s why many over-55s are asking themselves not “should I move my money?” but “how fast should I move it?”

What Can You Do If You Want More Control?

Many pre-retirees are now considering what they can control, especially when trust in future state support is low.

If you’re over 55, still working or semi-retired, and you’ve built up a private pension pot, you have some options:

Option 1: Take the Tax-Free Lump Sum

Up to 25% of your pension can currently be withdrawn tax-free, subject to a cap of £268,275. For many, this is the largest untaxed withdrawal they’ll ever have access to, and it’s at risk of being reduced.

Labour has promised to preserve the 25% allowance in its current form, but some financial analysts believe the £268,000 cap could be lowered, frozen further or removed entirely – especially for higher earners or large pots.

Option 2: Keep It in the Fund

Some people choose to leave their money invested in their pension scheme. This can be beneficial if:

- You want your money to grow tax-free

- You’re not ready to withdraw yet

- You believe policy changes won’t affect you significantly

The risk? You’re keeping it inside a policy-governed structure, potentially exposed to rule changes on access age, drawdown rules and inheritance tax.

Option 3: Move Funds Outside the Pension System

This is increasingly popular among cautious, financially aware savers who want to:

- Hedge against inflation

- Avoid being caught by shifting tax policy

- Retain access without early withdrawal penalties

That leads us to a growing category of savings: asset-based money.

Why Some Pre-Retirees Are Turning to Gold-Based Accounts

Gold isn’t new. But what’s new is how it’s now being made practical for daily use, thanks to fintech innovations.

Traditionally, physical gold had three major barriers:

- Accessibility: Buying bullion was often expensive, opaque, or required specialist brokers.

- Usability: You couldn’t spend gold. You’d have to sell it, pay fees, then convert to cash.

- Security: Storing gold safely meant high insurance and vaulting costs, making it impractical for most people.

TallyMoney changes that by offering a gold-based account, where:

- 1 tally = 1 milligram of real, physical gold

- That gold is vaulted securely in your name

- You can spend it like cash via a TallyMoney Debit Mastercard®

- You can move between tally and GBP, without transaction fees or FX margins

You’re not investing in gold ETFs, crypto, or speculative products. You’re owning real, physical gold and using it like money.

This is not about abandoning ISAs or pensions. It’s about complementing them with something that isn’t tied to political or banking risk.

“Isn’t Gold Hard to Access or Sell?”

This is one of the biggest misconceptions, and it’s a valid one, historically.

But with platforms like TallyMoney:

- There’s no need to sell your gold to spend it

- There are no FX margins or transaction fees when using it

- You’re not dealing with coins or bars, you see your balance in milligrams and GBP equivalent, in real time

The key distinction is this: you own physical gold, not a financial product priced in gold. That’s what separates TallyMoney from so-called “gold-backed tokens” or synthetic funds.

Final Thought – Time Brings Policy Change, Not Certainty

We don’t know exactly when, but history tells us pension rules will change again.

The state pension age is moving. Tax treatment is under review. Inflation is eroding savings. And most over-55s don’t feel confident that the current system is working for them.

Rather than waiting for the following announcement, many are choosing to take a portion of their future into their own hands, not out of fear, but out of foresight.

If you’re one of them, you’re not alone.