Did you know that you’re paid interest when you deposit and save money in the bank, because you’re actually loaning money to the bank?

Read on to find out why banks pay you interest, the huge difference between bank borrowing and lending interest rates, and why there are better choices for savers than saving in a typical bank.

Key takeaways:

https://www.tallymoney.com/wp-content/uploads/2022/11/radio-button-on-outline.svg

- Saving in a bank account is the same as loaning money to the bank

- Savers receive very low interest in return for loaning their money to the bank

- But when the bank loans savers money, they’re charged much higher interest rates

- Saving in a traditional bank account isn’t always helpful for savers; there are better options.

Why do banks want your money?

Banks are more than happy to take your money. That’s because they use it to fund things like loans, mortgages and credit cards. They then charge you, or other borrowers, interest to use these services and make massive profits.

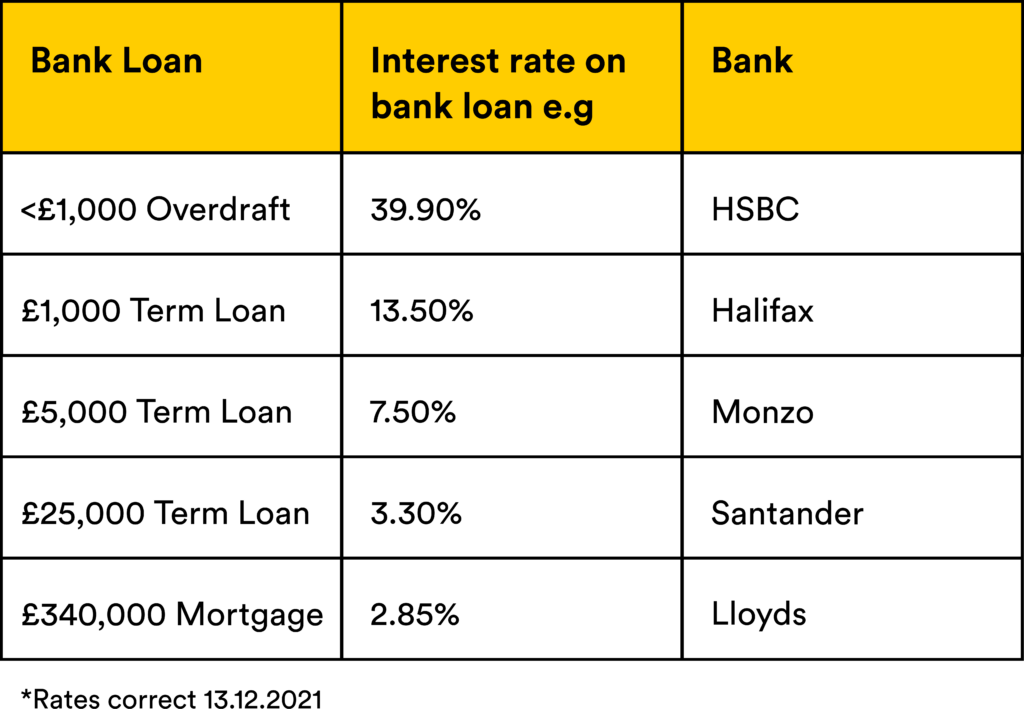

Here’s a snapshot of bank loans currently available:

How does lending compare to borrowing?

Most people need to borrow money at some point, whether that’s for buying expensive items like a car or property, or for unexpected emergencies. And everyone needs to save money somewhere to work towards their financial goals.

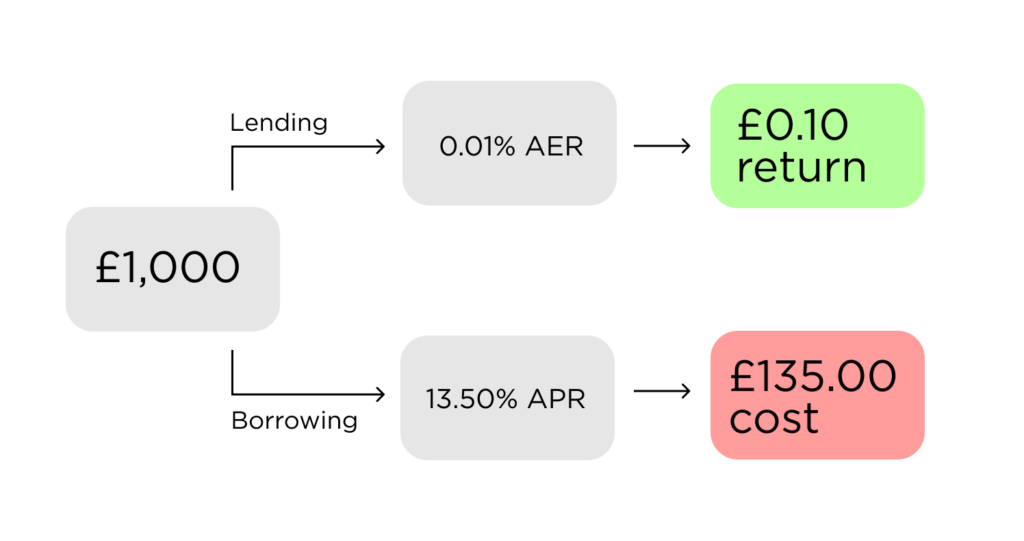

Let’s take a look at the difference between loaning £1,000 to the bank versus loaning £1,000 from the bank:

The difference between lending money to the bank and borrowing money from a bank is huge. For a person to lend £1,000 money to the bank, the bank would pay them just 10p in return if saved in a typical 0.01% AER savings account. For the same person, or someone else, to borrow £1,000 from the bank, the bank would charge them £135.

And when you take into account inflation, currently at over 4.00%, the money you save in any bank account which returns less than the rate of inflation, is actually constantly losing value in terms of purchasing power over time.

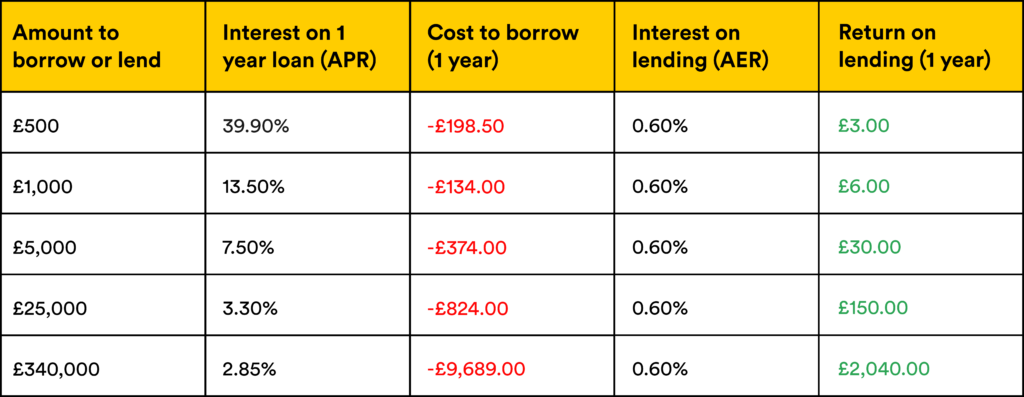

And from overdrafts to mortgages, the trend is the same:

Banks are making huge profits from savers’ money; their money is working hard for the banks, but is barely noticeably working for savers themselves.

How can you make your money work harder for you?

Reviewing the numbers above, it’s understandable that most of us would want to make our hard-earned money work harder for our own futures, instead of bank profits.

Everyday savers – that’s regular people as opposed to ultra-rich, companies or professionals – have always looked to protect their wealth.

But in the past, it was much harder for them to save effectively. High fees and old financial technology made it harder for everyday savers to save than it should be.

That’s changed over the past years as new cost-effective providers, benefiting from improved banking and financial technology, have developed apps and platforms to make it simple for savers to upgrade their money.

Here at Tally, we’ve built our app to help everyday savers unlock the benefits of saving in a currency backed by physical gold, that you can save and spend just like pounds. Whilst it can fluctuate up and down in the short term relative to GBP, gold is a physical asset that’s proven to increase in value over time, making it an excellent store of value compared to fiat currencies like £GBP.

Savers now have the power to make better choices for their money, which benefit them, not a bank.