The 2025 Pension Shake-Up is Coming

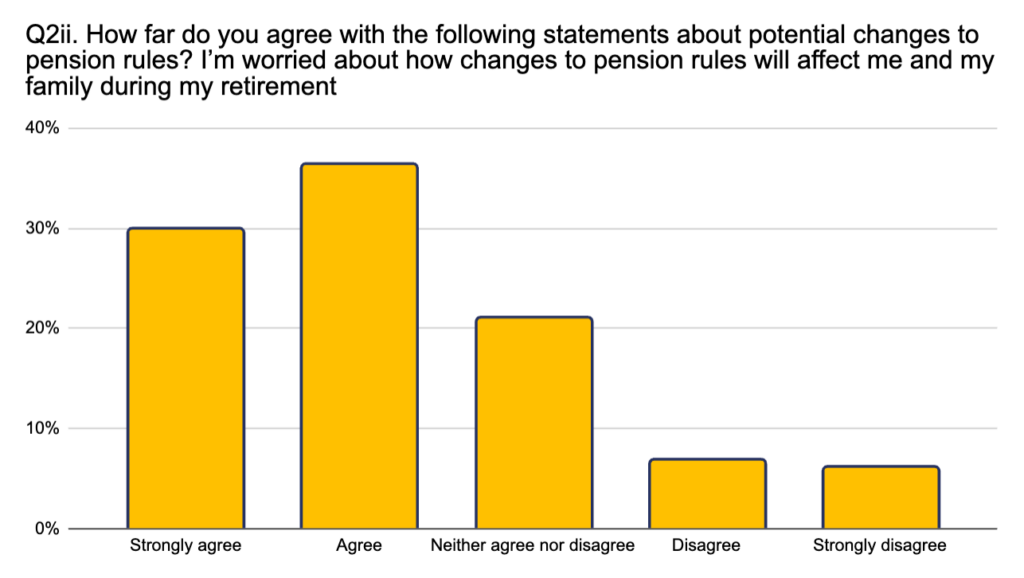

For decades, UK pensions have provided a sense of financial security, allowing retirees to plan for a stable future. However, with 66% of pre-retirees worried about how pension drawdown rules changes will impact them, it’s clear that confidence is wavering. And with good reason.

Changes to pension drawdown rules, taxation policies, and inflation pressures mean that what worked for previous generations may no longer be enough. From April 2027, pensions will be subject to inheritance tax (IHT), dramatically altering how wealth is passed down. Meanwhile, speculation about reducing the 25% tax-free lump sum allowance has left many questioning whether they should access their pension earlier than planned.

At the same time, inflation continues to erode the real value of money. A pension pot that seemed substantial five years ago may not stretch as far today. Low interest rates on savings accounts only make matters worse, offering retirees little growth potential outside of traditional pension drawdowns.

With all these uncertainties, relying solely on a traditional pension pot could leave you exposed to unexpected costs and limitations. Whether you’re planning to withdraw a lump sum, opt for flexi-access drawdown, or invest in an annuity, it’s crucial to reassess your approach. Is your pension future-proof? Will it stand up to economic shifts, tax hikes, and market volatility?

This guide explores what’s changing, the risks of outdated pension strategies, and how to diversify your retirement income to ensure a financially secure future. Let’s break it down.

The Problem with Traditional Pension Drawdown

Pension drawdown is one of the most flexible ways to access retirement savings, but recent economic shifts and regulatory changes are making it riskier than before.

Inflation: The Silent Wealth Eroder

Pensions are built to last, but inflation can drain your purchasing power faster than expected. According to the Office for National Statistics (ONS), the UK’s inflation rate has fluctuated between 4% and 10% in recent years, meaning that a £100,000 pension today could be worth just £74,409 in a decade.

Most pensions are invested in low-risk, low-return assets, meaning they may not grow fast enough to keep pace with inflation. This puts retirees in a difficult position—either withdraw more each year or accept a declining standard of living.

The Tax-Free Lump Sum May Not Last

One of the biggest benefits of UK pensions is the ability to withdraw 25% of your pension pot tax-free, but this rule is under increasing scrutiny. While no official changes have been announced, some financial experts warn that the government could reduce this allowance in future budgets to increase tax revenue. The Institute for Fiscal Studies has proposed scrapping the 25% tax-free pension withdrawal, and with the current government’s keen interest in pension reform, there is concern this idea will find its way into policy.

If this happens, retirees who haven’t already withdrawn their tax-free sum will lose out. This makes it crucial to reassess the timing of your pension withdrawals and consider whether utilising your tax-free lump sum withdrawal before potential changes take effect could be beneficial.

Inheritance Tax is Coming for Your Pension

Until recently, pensions were one of the few assets that were exempt from inheritance tax (IHT), making them a smart way to pass down wealth to family members. However, starting April 2027, pensions will be subject to the same 40% inheritance tax as other assets.

This means that if you plan to leave your pension to your children or grandchildren, a large portion of it will likely go straight to the government instead. Finding alternative ways to preserve wealth and transfer assets outside of pension structures is now more important than ever.

Alternative Strategies to Future-Proof Your Pension

Given these challenges, it’s time to rethink retirement strategies and explore alternative ways to safeguard wealth. Here are some options:

Asset-Based Savings: Gold as a Safe Haven

One of the most reliable ways to preserve wealth against inflation and economic instability is through gold. Unlike cash or traditional investments, gold retains its intrinsic value over time.

- Gold has historically outperformed inflation, maintaining its purchasing power for centuries.

- It isn’t subject to the same banking and pension regulations that can limit access to your money.

- Modern gold-based savings solutions, such as TallyMoney, provide the flexibility of a bank account while holding real physical gold.

TallyMoney offers retirees a way to store savings in an asset that isn’t affected by government policy shifts or financial crises.

Individual Savings Accounts (ISAs) for Tax-Free Growth

ISAs provide a tax-efficient way to grow wealth without worrying about capital gains or income tax.

- Cash ISAs allow for tax-free savings, though interest rates are typically low and likely to not outpace inflation. Meaning real-value erodes over time..

- Stocks & Shares ISAs provide potentially higher returns, though they carry stock market ups and downs investment risk.

- Innovative Finance ISAs offer access to peer-to-peer lending opportunities for those comfortable with alternative investment vehicles with no insurance or security.

Property Investment: Generating Passive Income

Real estate has long been a favoured asset class for long-term wealth preservation.

- Rental income provides a steady cash flow without needing to withdraw large lump sums from a pension.

- Property values generally rise over time, offering capital appreciation potential.

- Investing in real estate through a pension (SIPP or SSAS) can provide additional tax benefits.

- However property ownership is complex, requires ongoing management, exposes landlords to tenant risks, and requires keeping pace with legislative changes. Hardly a ‘retirement’ solution.

- In addition property ownership is highly illiquid and complex to sell.

While property investment requires management and maintenance, it can serve as a hedge against pension instability and tax changes.

Taking Control of Your Retirement Plan

Many pre-retirees are now taking proactive steps to secure their financial future by diversifying their retirement income. So what does the ideal solution look like?

- It should be low complexity.

- It should offer the potential for inflation-beating growth.

- It should be 100% secure.

- It should be within your total control.

- It should be easily accessible and liquid in case you need it.

Steps to take control of your retirement plan.

- Assess your current pension drawdown plan—ensure it’s aligned with new tax rules and inflation realities.

- Consider alternative savings vehicles—gold, ISAs, and property can help protect wealth outside traditional pensions.

- Consider how it meets the ‘ideal list’ above.

- Stay informed about regulatory changes—pension rules are evolving, and adapting early can prevent costly mistakes.

The financial landscape is shifting, but by planning ahead, you can ensure your retirement remains secure and flexible.

Final Thoughts: Future-Proof Your Retirement Today

Relying solely on traditional pension drawdown may no longer be the safest route to a financially secure retirement. With rising taxes, inflation, and new government regulations, retirees must look beyond pensions and consider alternative wealth preservation strategies.

By integrating gold-based savings, tax-efficient ISAs, and diversified investments, you can protect your wealth and gain the flexibility to enjoy retirement on your own terms.

With major pension changes on the horizon, now is the time to ask: Is your pension future-proof? If not, it’s time to take action.